Our Market

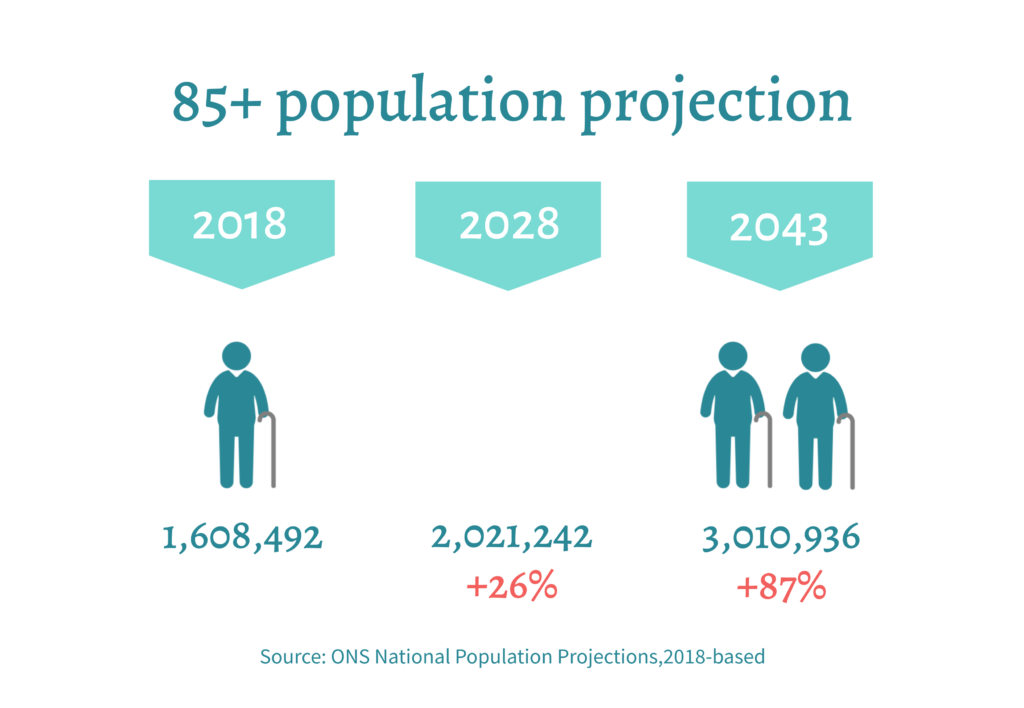

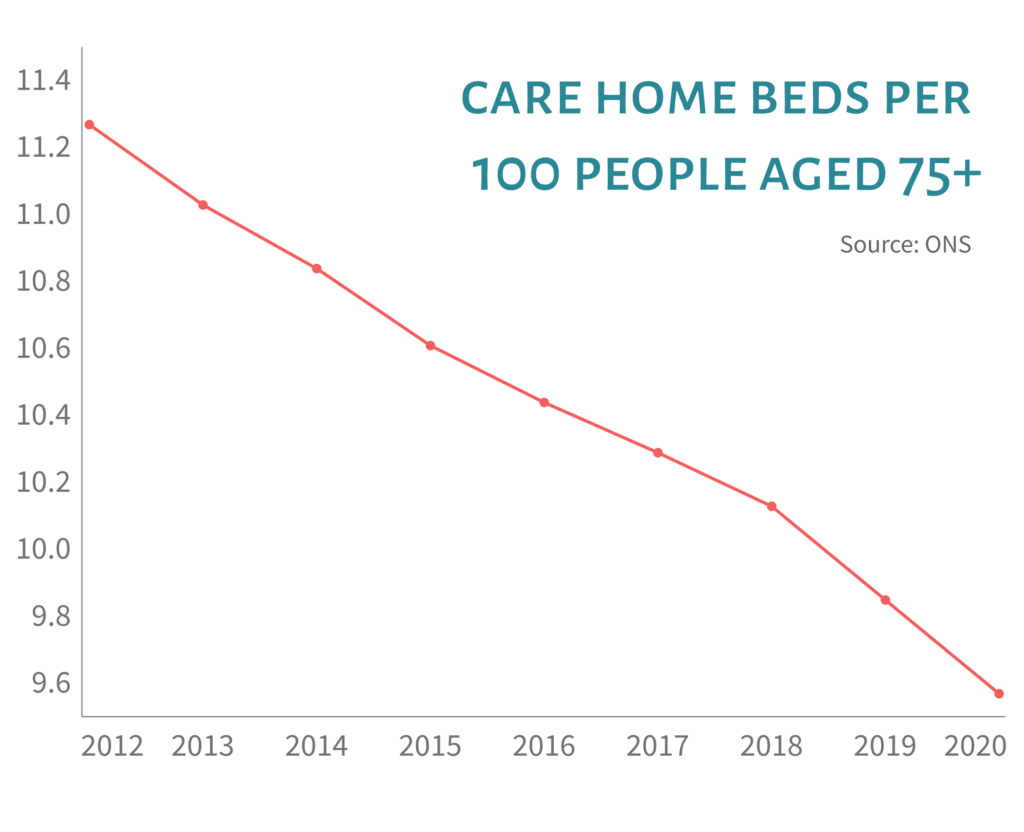

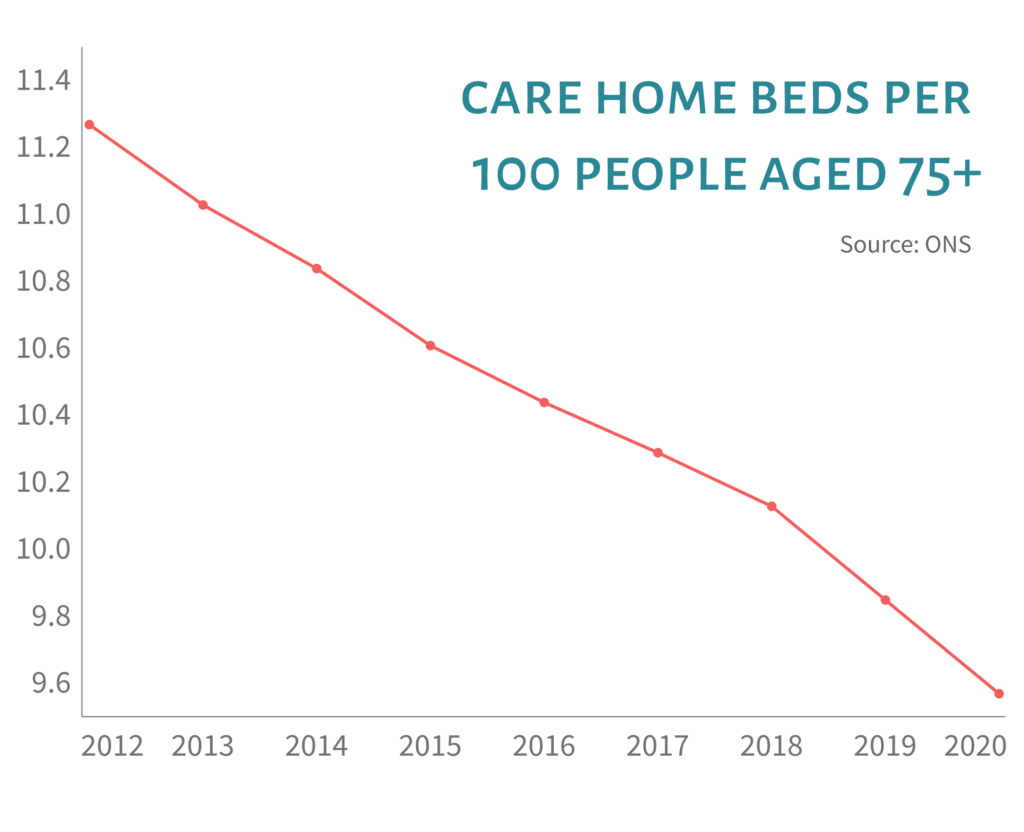

Healthcare real estate is a dynamic and developing sector underpinned by strong demographic demand.

There is scope to develop new innovative models of care to respond to the opportunities and challenges of the social care market.

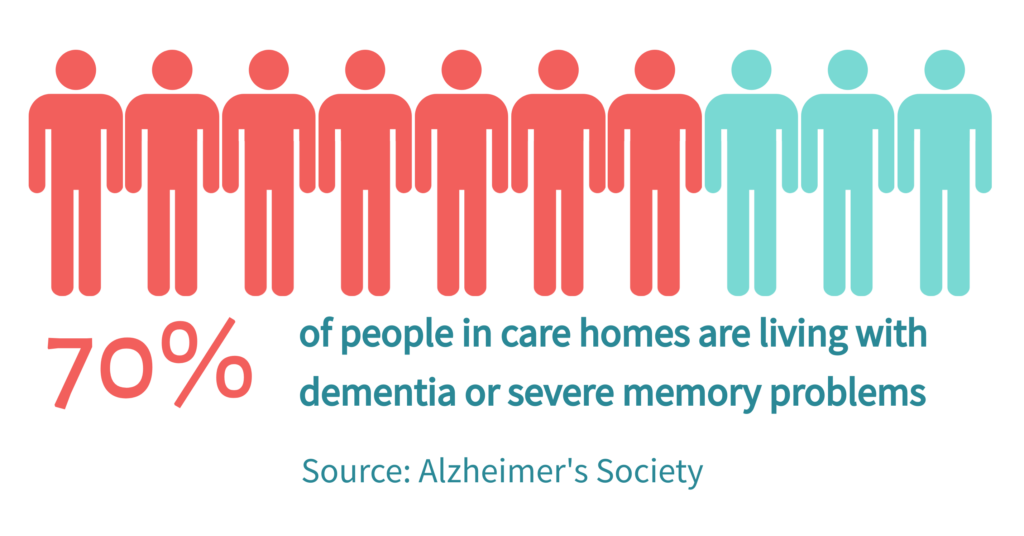

More specialised care services to address the differing needs of an aging population.

In response to the growing number of people living with dementia, specialist dementia care units are being built to dementia friendly designs to reduce anxiety for residents.

More specialised care services to address the differing needs of an aging population.

In response to the growing number of people living with dementia, specialist dementia care units are being built to dementia friendly designs to reduce anxiety for residents.

Greater choice of senior living options for the more active section of the aging population.

There is still a relatively low supply of housing with care (retirement villages, extra care housing) compared to countries such as Australia and the US.

As the market matures, there will be more focus on understanding consumer needs.

Marketing techniques employed in other sectors are being introduced into social care, allowing easier comparison of fees and services.

As the market matures, there will be more focus on understanding consumer needs.

Marketing techniques employed in other sectors are being introduced into social care, allowing easier comparison of fees and services.

COVID-19 has highlighted the importance of infection control in care homes.

Modern designs for purpose-built care homes can support effective infection control as well as optimal staffing levels and tackle the net carbon challenge.

Healthcare real estate, as an alternative asset class is becoming more attractive to a wider range of investors, beyond the specialist healthcare funds.

Institutional investors are searching for defensive assets that have long-term, secure income streams. Care assets are underpinned by strong demographic demand from an aging population.

Healthcare real estate, as an alternative asset class is becoming more attractive to a wider range of investors, beyond the specialist healthcare funds.

Institutional investors are searching for defensive assets that have long-term, secure income streams. Care assets are underpinned by strong demographic demand from an aging population.

ESG

The ESG (Environmental Social Governance) agenda is drawing new investors to the healthcare sector.

ESG factors are now integrated into the investment decision process alongside financial reporting for many investors. The focus is on material risks, climate change being one that all sectors need to address.

The challenge for investors is how to assess ESG performance without a common reporting framework.

The social care sector does benefit from having the CQC (or equivalent) regulatory framework that covers some areas of material ESG risk.

An interesting precedent is the Sustainability Reporting Standard for Social Housing, launched in November 2020 by the ESG Social Housing Working Group, a collaboration between housing associations, banks, investors and sector experts, to promote transparent and consistent ESG reporting that makes it easier for lenders and investors to assess and compare ESG performance of housing providers.

ESG does not necessarily create a conflict between shareholder returns and positive social and environmental outcomes. It can encourage innovation and generate more sustainable opportunities.

ESG does not necessarily create a conflict between shareholder returns and positive social and environmental outcomes. It can encourage innovation and generate more sustainable opportunities.

Covid-19 put the spotlight on adult social care and the longstanding failure of successive governments to honour their promises to “fix” the way it is funded.

The current system limits state support to all but those with the highest level of need and the lowest means.

The Dilnot Commission reforms – including putting a cap on care fees paid by an individual in their lifetime – still seem to be the favoured approach by the politicians ten years on. There is general consensus on many of the issues such as integrating health and social care, but the sticking point remains how to pay for the reforms.

There must come a point when the government will have to stop “kicking the can down the road” – the ensuing reforms will hopefully invigorate new areas of the market and bring new opportunities.

*CMA Care Homes Market Study, Nov 2017; The King’s Fund Social Care 360 report, May 2021

There must come a point when the government will have to stop “kicking the can down the road” – the ensuing reforms will hopefully invigorate new areas of the market and bring new opportunities.

*CMA Care Homes Market Study, Nov 2017; The King’s Fund Social Care 360 report, May 2021